Transition to retirement

A flexible way to transition into retirement

Learn moreReduce your work hours without reducing your take-home pay.

Employer contributions will still go into your existing super account, keeping you invested and building your wealth.

Choose how much you’ll receive and how often.

Broad range of investment options for the conservative through to aggressive investor.

Investment earnings taxed up 15%, no tax payable on income payments after 60, 15% tax offset up to 59*.

Low administration and investment fees.

*15% tax offset on the taxable component of your income stream payments if you are between preservation age and age 59.

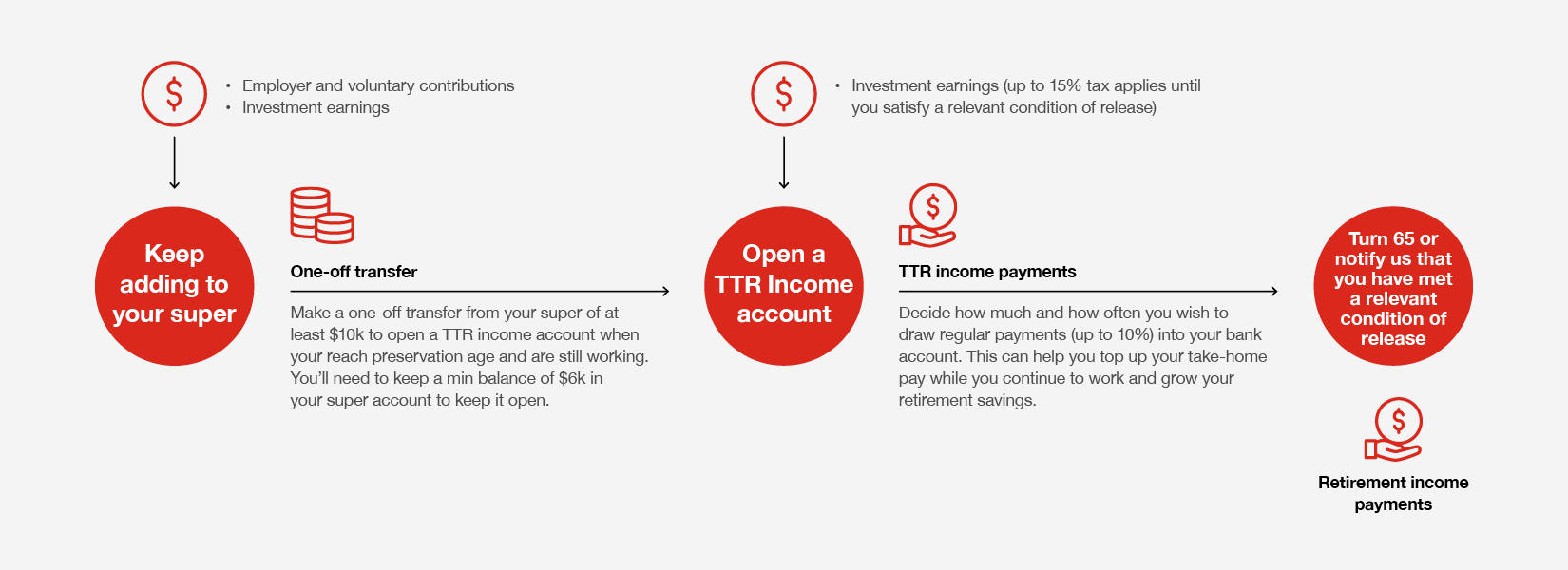

Your super account continues to receive employer contributions plus any investment earnings while you’re still working. You open a TelstraSuper RetireAccess TTR account using some of your funds from your super account to pay you a regular income. TTR payments are tax free from age 60.

Here are some key things to keep in mind when considering a Transition to Retirement strategy.

You can start a TTR when you have reached your preservation age and are still working.

The minimum amount you must transfer into a TTR income account is $10,000.

TTR income payments can only be received from the TTR income account.

You can withdraw up to 10% of your TTR account balance annually.

Read the TelstraSuper RetireAccess Product Disclosure Statement and Transition to Retirement Target Market Determination.

Download PDSComplete the Income Stream application form in SuperOnline. Or new members can download the form from our website.

Download formWe're here to help you build a secure financial future. TelstraSuper Financial Planning has a team of phone-based Advisers who can provide you with simple advice* to help you work out the best ways to maximise your super in retirement.

If you'd like to discuss your retirement plans or if you have another financial advice queries, please call us on 1300 033 166 or fill in our online contact form. Fees may apply.

We recommend you read the Product Disclosure Statement (PDS) and Target Market Determination before completing the TelstraSuper RetireAccess application form and contact us if you have questions.